Executive summary

In 2022, overall European Union industrial employment and output increased above 2021 levels, despite rocketing energy prices. However, output declined from energy-intensive industries including basic metals, chemicals, non-metallic minerals and paper, for which energy costs represent a much bigger share of production costs than for less energy-intensive manufacturing. Energy prices are likely to remain above historic levels for the foreseeable future.

In its industrial strategy response to this context, the EU must ask first whether the energy-intensive parts of the value chain should be outsourced permanently. Conditional on the answer being no, the second question is how to reduce energy prices to ensure the competitiveness of the energy-intensive productions stages that remain in the EU.

First, the EU could bridge the high energy price period with unconditional subsidies, which seems to be the preferred strategy currently. This will avoid irreversible large-scale relocation abroad but is expensive, does not help to drive down energy prices and poses risks of fragmentation within the EU. It will only succeed if internationally competitive energy supplies are made available quickly.

Second, the EU could support decarbonised production processes built on large-scale deployment of domestic renewables, grid interconnectors and storage. This would accelerate the green transition and reduce clean-tech prices worldwide. However, EU taxpayers would bear the cost of new technologies, without any guarantee of solving the current cost-competitiveness issue.

Third, the EU could facilitate imports of energy-intensive products, while helping EU industry move to higher value-added parts of the value chain. Subsidies could be given directly to industrial sectors that have not become structurally uncompetitive, while bringing down energy demand and thus energy prices. However, this strategy would result in temporarily higher unemployment and factory closures in energy-intensive industries, would need to accommodate concerns over excessive reliance on imports and would need to be engineered to address carbon leakage.

Policymakers should implement a mix of these policies. The EU should subsidise existing energy-intensive industries only in clearly justified cases, while deciding which energy-intensive products can be left to international market forces. By choosing which decarbonisation investments should be supported in Europe, the EU can combine industrial competitiveness and environmental sustainability.

1 Introduction

Russia’s invasion of Ukraine in February 2022 made clear that Europe’s dependency on energy imports from Russia was a grave strategic liability. The energy crisis that followed Russia’s weaponisation of natural gas supplies showed how decoupling from Russian gas has become essential. In the decoupling effort, European industry, accounts for more than a third of total European Union final demand for electricity and natural gas, has a major role to play.

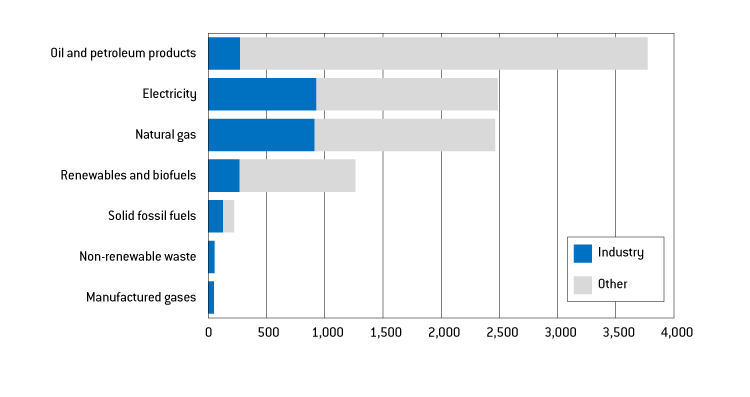

Industry uses energy – primarily natural gas and electricity (Figure 1) – for four main purposes: production of heat in industrial processes and for space heating in buildings; as feedstock to make products including plastics and chemicals; generation of steam for process heating and generation of electricity to run industrial processes; and to power machinery and industrial motors, lights, computers and equipment for heating, cooling and ventilation.

Figure 1: EU final energy use by type of energy, 2021 (TWh)

Source: Bruegel based on Eurostat. Note: In Eurostat’s energy balance datasets ‘industry’ is the aggregate of manufacturing, construction and mining and quarrying.

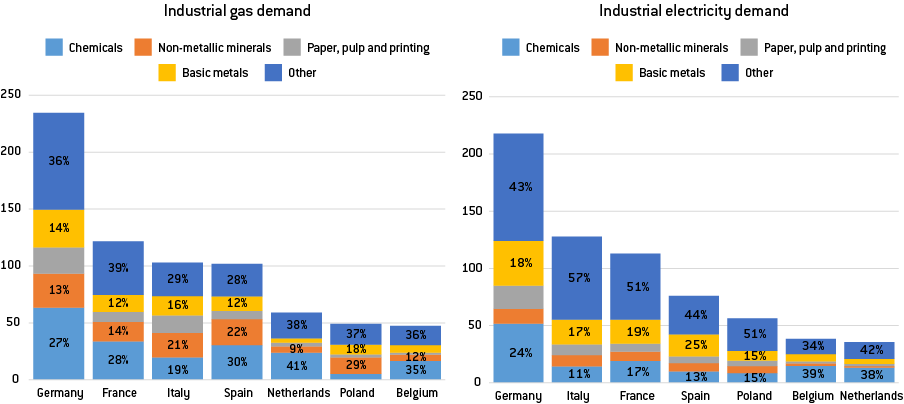

The four most energy-intensive industries in terms of gas and electricity demand in the EU are basic metals, non-metallic minerals, paper, pulp and printing, and chemicals 1 . The EU countries with the largest industrial natural gas and electricity use are Germany, France, Italy, Spain, the Netherlands, Poland and Belgium. In these seven countries, the four most energy-intensive industries account for 62 percent to 71 percent of total industrial gas demand, and 43 percent to 66 percent of industrial electricity consumption (Figure 2).

Figure 2: Gas and electricity consumption by country and industrial sector, TWh and %, 2021

Source: Bruegel based on Eurostat.

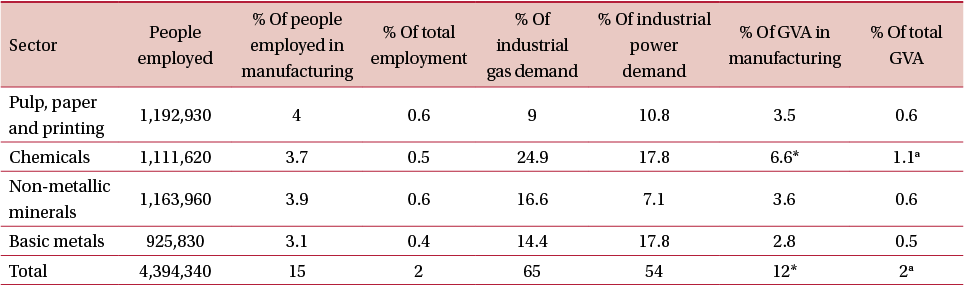

At the EU level, the chemicals, paper, basic metals and non-metallic minerals industries represent 65 percent of industrial gas and 54 percent of industrial power consumption. Their weight in terms of jobs and gross value added (GVA) is more limited, accounting for 15 percent of people working in manufacturing and 2 percent of total EU employment and GVA (Table 1). The chemicals sector, for example, accounts for a quarter of total industrial natural gas demand and almost 18 percent of industrial electricity consumption, but represents only 0.5 percent of EU jobs and 3.7 percent of EU manufacturing jobs (Table 1). While this snapshot does not take into account the indirect value-added these industries provide to other economic sectors 2 , it suggests that the importance of these industries might have been overstated in the public debate since the beginning of the energy crisis 3 .

Table 1: EU energy-intensive industries

Source: Bruegel. Note: *No data was available for the chemical sector GVA in Ireland and Sweden, so the EU numbers are biased slightly downwards. Pulp, paper & printing = manufacture of paper and paper products (C17) and printing and reproduction of recorded media (C18); chemicals = manufacture of chemicals and chemical products (C20); non-metallic minerals = manufacture of other non-metallic mineral products (C23); basic metals = manufacture of basic metals (C24).

2 What has happened to European industrial jobs and output during the energy crisis?

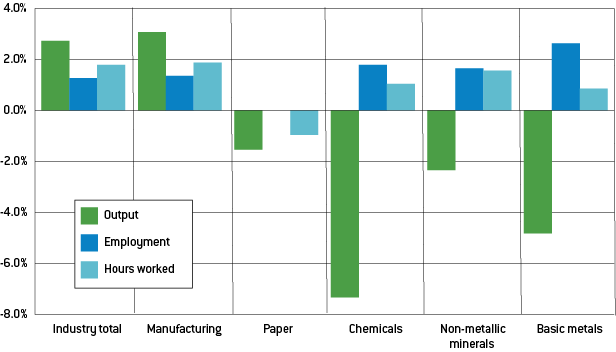

On aggregate, industrial output and employment have been unaffected, but the crisis impact is visible for individual sectors. Europe’s energy supply and price crisis started in September 2021, when Russia started to phase down gas flows to European buyers, resulting in 86 billion cubic metres of forgone supplies, or a 60 percent reduction in 2022 compared to 2021. In the first year of this, however, the EU did not experience the massive job losses that many warned would happen in case of a drastic reduction in natural gas supplies from Russia. By summer 2022, when energy prices peaked, industrial employment in the EU had actually increased, both in terms of people employed and hours worked, compared to the same period in 2021. Total manufacturing output was also higher (3 percent year-on-year in the third quarter of 2022, and continuing at the same level in the fourth quarter). However, output decreased in particularly energy-intensive subsectors, with chemicals experiencing the biggest fall (Figure 3).

Figure 3: Change in EU industrial output, employment and hours worked, Q3 2022, compared to same period 2021

Source: Bruegel.

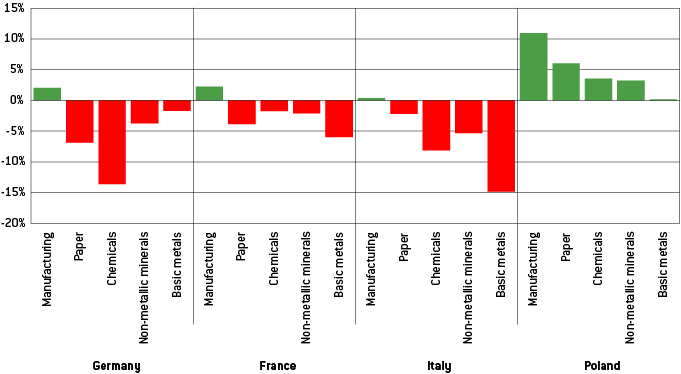

The energy mix of countries is likely to affect industrial output. The EU-wide figures hide significant differences between EU countries. Output from the chemical sector in Germany and basic metals in Italy, for example, changed much more significantly (-14 percent and -15 percent year-on-year, respectively) than the same sectors in Poland (+3.5 percent and +0.2 percent; Figure 4). The extent of use of natural gas in countries’ energy mixes is likely to be a major factor underpinning such differences. Industries in countries where the natural gas is a larger part of the energy mix – as in Germany and Italy – found themselves competing for gas with households and the power sector.

Figure 4: Percentage changes in production, in Germany, France, Italy and Poland, Q3 2022 compared to same period 2021

Source: Bruegel based on Eurostat.

3 Three policy strategies

When thinking about how to maintain the competitiveness of energy-intensive industry in Europe, and whether it is worth doing so, two linked questions need to be answered. First, would it be better to outsource permanently some parts of energy-intensive value chains? Second, if the answer to the first question is no, how can industrial energy prices be reduced to ensure the competitiveness of energy-intensive productions stages in the EU? To navigate the loss of Europe’s main external energy supplier and the subsequent impact on prices, EU policymakers have three options.

First would be to defend energy-intensive industry in its current form by using subsidies and production targets to bridge the high cost period until new cheap energy arrives. This implies substantial fiscal costs, and could undermine multilateral trade system that the EU has championed in the past. Furthermore, subsidising the current industrial players could mean missing the opportunity presented by the crisis to rethink the EU’s industrial model, and implicitly imposing higher energy prices and lower energy consumption on all non-supported sectors. However, this first strategy can be rationalised as maximising option value, given the potential irreversibility of allowing significant parts of energy-intensive industries to relocate abroad. The EU might maintain a comparative advantage in some of these industries, conditional on wholesale energy prices being lower in the very near future.

Second would be to transform energy-intensive industry in Europe, exploiting the crisis to boost the green transition by adopting clean technologies and focusing on domestic clean-energy production. In this scenario, policymakers should promote change with support conditional on companies implementing innovative clean technologies and boosting production of clean electricity. The main shortcoming of this strategy is its cost. Being a first mover in deploying at large scale new technologies to decarbonise energy-intensive sectors will likely require very substantial public support 4 , and might affect negatively the production cost-competitiveness of industry. Similarly to what happened with subsidies rolled-out in the early 2000s for the solar industry, in the medium-term this strategy will likely bring down the cost of clean technologies, with other regions of the world benefitting from upfront subsidy-driven demand in the EU.

The third policy strategy would be to help EU companies to import more energy-intensive intermediate products. While this approach would conflict with the focus on shortening value chains and domestic production targets, it would have the advantage of allowing a market-based reallocation of economic activity away from energy-intensive commodities and towards upper parts of the industrial value chain. This strategy might free-up fiscal space for governments, and would make energy cheaper for other industrial sectors. The main drawbacks of this strategy are the risk of carbon leakage, import security risks and short-term economic pain as factories shut down.

The energy crisis is an external shock that governments should exploit to rethink a traditionally rigid European industrial structure by putting at its core products in which the EU has a comparative advantage, and by fostering the green transition. The best approach would be a mix of the three strategies, but the weight to be given to each strategy is important and policymakers will have a decisive role in establishing the right policy mix. Better knowledge of value chains and a better sense of the EU’s comparative advantages will be instrumental in taking the right decisions to navigate through the structural changes to European industry that surely lie ahead.

3.1 Strategy 1: bridge the crisis and maintain the status quo

Policymakers so far have mostly pursued the first strategy: trying to preserve industry in its existing form. This political choice might have been the best response at the outbreak of the energy crisis, when there was a justifiable expectation, confirmed by subsequent events, that peak prices would be temporary. But extending this approach over the medium term will be costly, and makes sense only if further price declines are anticipated.

Governments have already allocated €672 billion in state aid to companies

Under the EU Temporary Crisis and Transition Framework adopted on 23 March 2022 in response to the Russian invasion of Ukraine (European Commission, 2022a), the Commission had by early 2023 already approved state aid subsidies of €672 billion to EU companies 5 . Moreover the EU emissions trading system (ETS) guidelines were revised to provide €60 billion between 2021 and 2030 in compensation for higher electricity costs in aluminium, steel and certain chemical sectors alone. Government subsidies have played an important role in supporting energy-intensive companies and related jobs in Europe, exerting the option value of keeping energy-intensive industry alive.

Without more coordination there is the risk of single market fragmentation, weakening EU cohesion

Within the current economic outlook of increasing interest rates and the relative increase in the cost of debt issuance, differences in the fiscal capacities of EU countries become even more marked than before. Governments find themselves in very different positions when it comes to supporting their national industries. There is a risk of an intra-European subsidy race to the detriment of the internal market and weaker countries/regions, and also European households and less energy-intensive sectors. Little to no harmonisation of the policies rolled out so far (Sgaravatti et al, 2023) risks undermining the fairness of the EU’s single market.

Measures such as price caps on natural gas and electricity for industrial consumers, for example, are decided nationally and vary from country to country 6 . Energy-intensive sectors in countries with generous support schemes will be able to outcompete their peers in other countries. But if all countries provide generous support in a specific sector to maintain a level playing field, this sector will consume more energy and hence make energy more expensive for all other sectors, reducing their competitiveness. If governments decide to support all industrial sectors (to maintain their output/energy consumption), then household energy prices will have to rise. And all this will imply a great fiscal stimulus ultimately benefitting energy producers, many of which pay taxes outside the EU.

If energy prices remain high, supporting energy-intensive activity would mean subsidising energy prices permanently

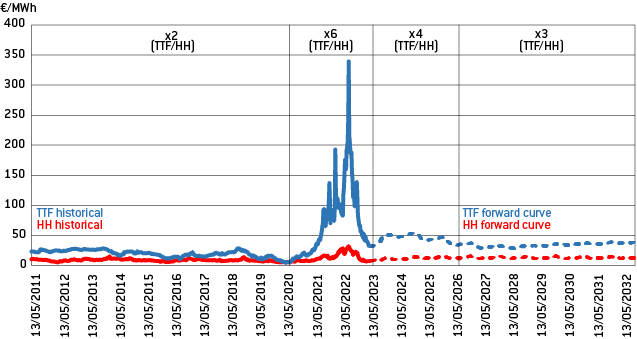

The massive increase in electricity and gas prices implied a drastic loss of competitiveness for European energy-intensive companies in 2022, and some of the effect is expected to persist. The price of natural gas in the EU is still substantially higher than before the crisis, despite having retreated from the mid-2022 peak. Financial markets expect this will remain the case for another three years, with prices at around €50/MWh, or four times the US price (Figure 5). Notwithstanding high uncertainty (flows from Russia could resume, bringing prices down, or stop completely with the opposite effect), in the baseline scenario the situation will not differ greatly from today and the EU will rely structurally more on liquefied natural gas than in the past (LNG deliveries have substituted about half of the loss of Russian pipeline flows). This development will result in a permanent increase in gas prices for EU companies as US LNG shipments are 52 percent per unit more expensive than average pipeline gas imported into the EU (Di Comite and Pasimeni, 2023).

Figure 5: Wholesale natural gas prices in Europe and the US, €/MWh

Source: Bruegel based on Bloomberg. Note: TTF indicates the price of the Title Transfer Facility, the European benchmark for the price of natural gas, while HH indicates the price of Henry Hub, the US natural gas benchmark price. The annotations in the different sections of the graph indicate how much more expensive TTF is over HH (for example x2 (TTF/HH) indicates that TTF is twice as expensive as the HH).

Therefore, national policies to temporarily bridge a gap in energy-price competitiveness might be made permanent if high EU energy prices relative to competing economies continue, providing an ongoing justification.

Access the full publication here

About the Authors

Giovanni Sgaravatti works at Bruegel as a Research analyst.

Simone Tagliapietra is a Senior Fellow at Bruegel. He is also a Professor of Energy, Climate and Environmental Policy at the Catholic University of Milan and at The Johns Hopkins University – School of Advanced International Studies (SAIS) Europe.

Georg Zachmann is a Senior Fellow at Bruegel, where he has worked since 2009 on energy and climate policy.